NAIROBI, Kenya May 3 – Senators are pushing for a sweeping amendment of the Public Finance Management (PFM) Act aimed at curbing the widespread and often unauthorized use of commercial bank accounts by county governments.

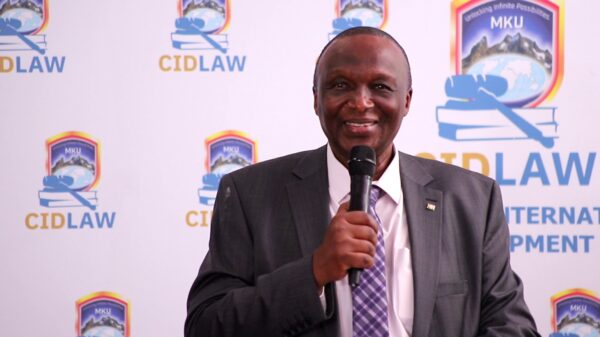

The Senate’s Standing Committee on Devolution and Intergovernmental Relations chaired by Senator Mohamed Abass, has raised alarm over the proliferation of bank accounts outside the Central Bank of Kenya (CBK), a direct violation of Regulation 82(1)(b) of the PFM (County Governments) Regulations, 2015.

The regulation stipulates that all county government bank accounts, except for petty cash imprest accounts, must be operated at the CBK to ensure fiscal transparency and accountability.

Despite the law, many of the 47 devolved units continue to maintain commercial bank accounts across the country. This has led to fragmented financial reporting, weakened oversight, and inefficient budget execution raising concerns among oversight bodies.

“We need to review the legal provisions under the PFM Act and related regulations so that we ensure compliance in the opening and management of county government bank accounts,” said Senator Abass.

He emphasized that without clear enforcement mechanisms, financial discipline among counties remains elusive.

Meeting with the Council of Governors (COG), the Controller of Budget, and the Office of the Auditor General, senators underscored the need to close dormant or unauthorized accounts, strengthen penalties for non-compliance, and develop a streamlined framework for account reconciliation and approval through the National Treasury.

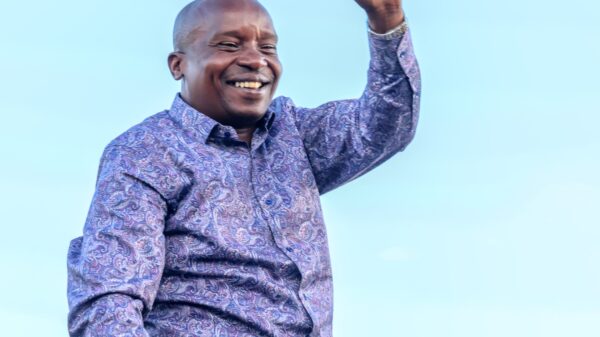

Counties, however, defended their use of multiple accounts. Kakamega Governor Fernandes Barasa, who chairs the COG’s Finance Committee, attributed the practice to conditions imposed by international development partners, who often require project-specific accounts as part of grant agreements.

“Counties have many bank accounts as part of the requirement from our development partners.I agree with the Committee that we need to amend the law to give us more flexibility,”said Governor Barasa

Controller of Budget Margaret Nyakang’o and Auditor General Nancy Gathungu supported the legislative overhaul, urging lawmakers to empower oversight institutions to impose sanctions, such as delaying disbursements to counties that violate financial rules.

They also called for a unified approach to fund flow managementrequiring all grants and donor funds to be first deposited in the County Revenue Fund before being transferred to specific project accounts.